Robins Federal Credit Union stands out as a beacon of hope for those seeking financial stability and growth. Established with a mission to provide exceptional service and financial products, Robins Federal Credit Union has become a trusted institution for its members. This article delves into the various offerings, member benefits, and the overall significance of this credit union in the financial landscape. Whether you're looking to open an account, apply for a loan, or simply learn more about credit unions, this article will serve as your ultimate guide.

As we explore the ins and outs of Robins Federal Credit Union, we'll highlight the aspects that set it apart from traditional banks. The focus will be on its commitment to serving the community, providing competitive rates, and ensuring member satisfaction. By the end of this article, you will have a clearer understanding of how Robins Federal Credit Union can help you achieve your financial goals.

Additionally, we'll discuss the importance of credit unions in today's economy. With an emphasis on member ownership and community involvement, credit unions like Robins Federal not only offer financial services but also contribute to the overall well-being of their members and the communities they serve. Let's embark on this journey to discover the many facets of Robins Federal Credit Union.

Table of Contents

Introduction to Robins Federal Credit Union

Robins Federal Credit Union operates under the philosophy of serving its members first, providing a wide array of financial services designed to meet individual needs. Established in 1953, it has grown significantly over the years, adapting to the changing financial landscape while remaining committed to its core values. With a focus on member education and empowerment, Robins Federal Credit Union emphasizes financial literacy as a vital component of its mission.

History of Robins Federal Credit Union

Robins Federal Credit Union was founded to serve the employees of Robins Air Force Base in Warner Robins, Georgia. Over the years, it has expanded its membership to include various community groups and organizations. The credit union's commitment to its members and the community has been a driving force behind its growth and success.

Key Milestones

- 1953: Founded by a small group of dedicated individuals.

- 1970s: Expanded membership eligibility to include more community members.

- 2000: Launched online banking services to enhance member convenience.

- 2020: Celebrated 67 years of service to the community.

Membership Eligibility and Benefits

Joining Robins Federal Credit Union is simple and accessible. Membership is open to anyone who lives, works, worships, or attends school in the service areas of the credit union.

Benefits of Membership

- Access to competitive rates on loans and savings accounts.

- No monthly maintenance fees on checking accounts.

- Online and mobile banking for convenience.

- Financial education resources and workshops.

Financial Services Offered

Robins Federal Credit Union offers a wide range of financial services to meet the diverse needs of its members. From personal banking to business services, the credit union is dedicated to providing quality financial products.

Personal Banking Services

- Checking and savings accounts

- Certificates of deposit (CDs)

- Individual retirement accounts (IRAs)

Business Banking Services

- Business checking and savings accounts

- Merchant services

- Business loans and lines of credit

Loan Products Overview

Robins Federal Credit Union offers a variety of loan products tailored to meet the needs of its members. Whether you are looking to buy a home, finance a car, or consolidate debt, the credit union has options available for you.

Types of Loans Available

- Mortgage loans

- Auto loans

- Personal loans

- Credit cards with competitive rates

Community Involvement

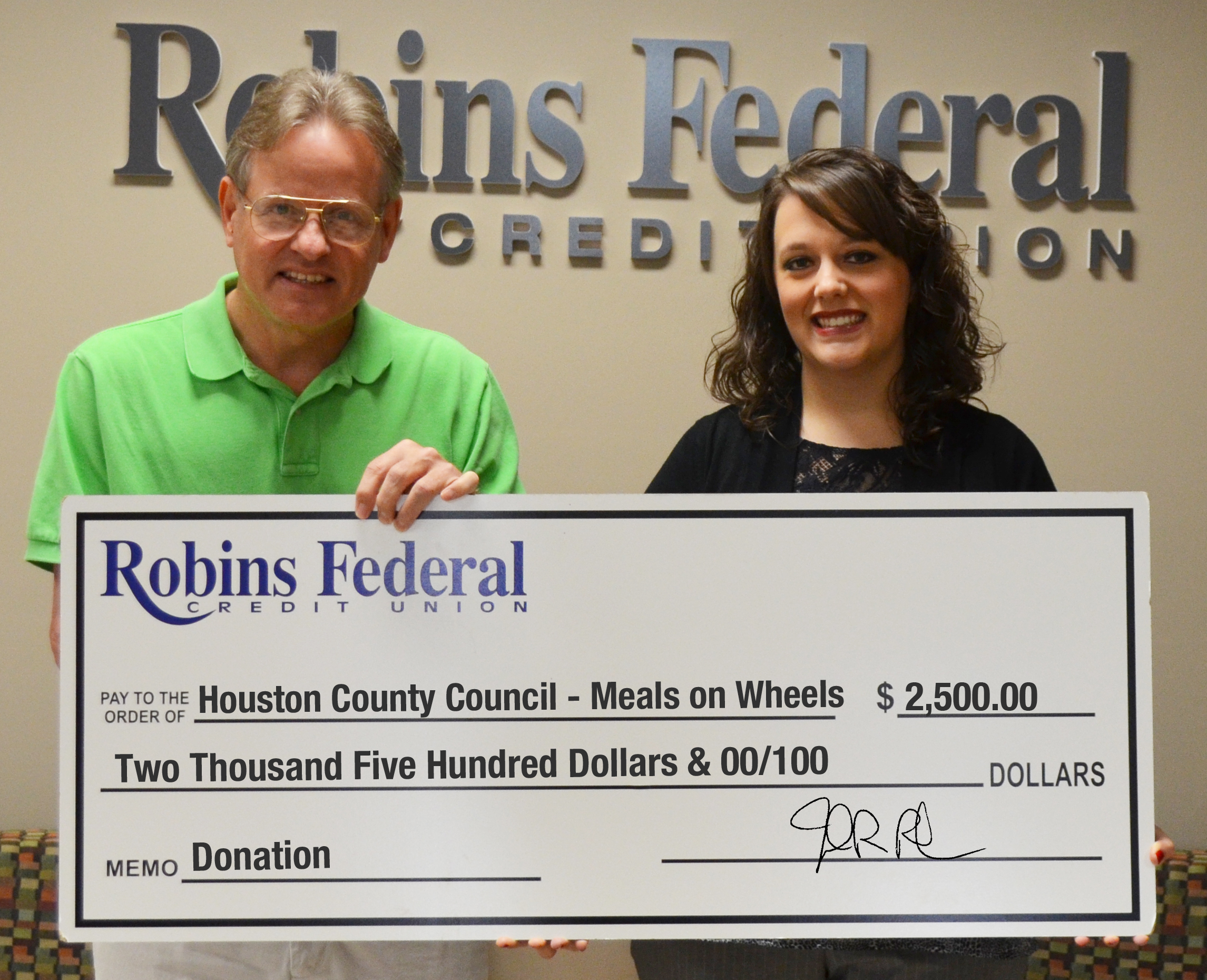

Robins Federal Credit Union takes pride in its community involvement. The credit union actively participates in various local events and initiatives to give back to the community it serves.

Community Programs

- Financial literacy workshops for schools and organizations.

- Support for local charities and non-profits.

- Volunteering opportunities for employees and members.

Savings and Investment Options

In addition to traditional savings accounts, Robins Federal Credit Union offers various investment options to help members grow their wealth over time. With competitive rates and flexible terms, members can choose the savings plan that best fits their financial goals.

Investment Options

- High-yield savings accounts

- Certificates of deposit (CDs)

- Retirement accounts with tax advantages

Conclusion

Robins Federal Credit Union continues to be a trusted partner in financial wellness for its members. With a commitment to providing exceptional services, competitive rates, and community involvement, it is clear that this credit union is dedicated to improving the financial lives of those it serves. If you are interested in becoming a member or learning more about the services offered, visit the Robins Federal Credit Union website today.

We encourage you to share your thoughts in the comments section below, or explore additional articles on our site for more information on financial wellness and credit unions. Your journey to financial security starts here!

Thank you for reading about Robins Federal Credit Union, and we hope to see you again soon!

Article Recommendations

ncG1vNJzZmilqZu8rbXAZ5qopV%2BcrrOwxKdoaWeipK%2BqutJmnZ6claeurXnCq5ydoaRjtbW5yw%3D%3D