The New York State Retirement System (NYSTRS) is a crucial aspect of financial planning for many public employees in New York. As individuals serve their communities, they seek to secure their financial future through various retirement options. This article aims to provide a comprehensive overview of the NYSTRS, including its structure, benefits, eligibility, and how it compares to other retirement systems. With a focus on expertise, authoritativeness, and trustworthiness, this guide will empower you with the information needed to navigate the retirement landscape in New York State.

In today’s economy, planning for retirement is more important than ever. For those who have dedicated their careers to public service in New York, understanding the intricacies of the NYSTRS is essential. This system not only rewards years of service but also ensures a stable income during retirement. With the right knowledge, employees can maximize their benefits and enjoy a comfortable retirement.

Throughout this article, we will explore various aspects of the NYSTRS, including its eligibility requirements, types of retirement plans, and the calculation of benefits. By the end, you will have a thorough understanding of how the New York State Retirement System operates and how it can significantly impact your financial future.

Table of Contents

What is the New York State Retirement System?

The New York State Retirement System is a public pension system that provides retirement benefits to employees of the state and local governments, including teachers, police officers, and other public service employees. Established in 1920, the system has evolved to meet the changing needs of its members.

NYSTRS operates under a defined benefit plan, meaning that retirement benefits are calculated based on a formula that considers the employee's years of service and final average salary. This system aims to provide financial security and stability for retirees, ensuring they can maintain their standard of living.

Key Features of NYSTRS

- Defined benefit plan

- Multiple retirement options

- Cost-of-living adjustments

- Disability and survivor benefits

Eligibility Requirements

To qualify for retirement benefits under NYSTRS, members must meet certain eligibility criteria. Generally, eligibility is based on age and years of service. Here are the primary requirements:

- Minimum age of 55 for Tier 1 and Tier 2 members

- Minimum age of 62 for Tier 3 and Tier 4 members

- At least 5 years of credited service

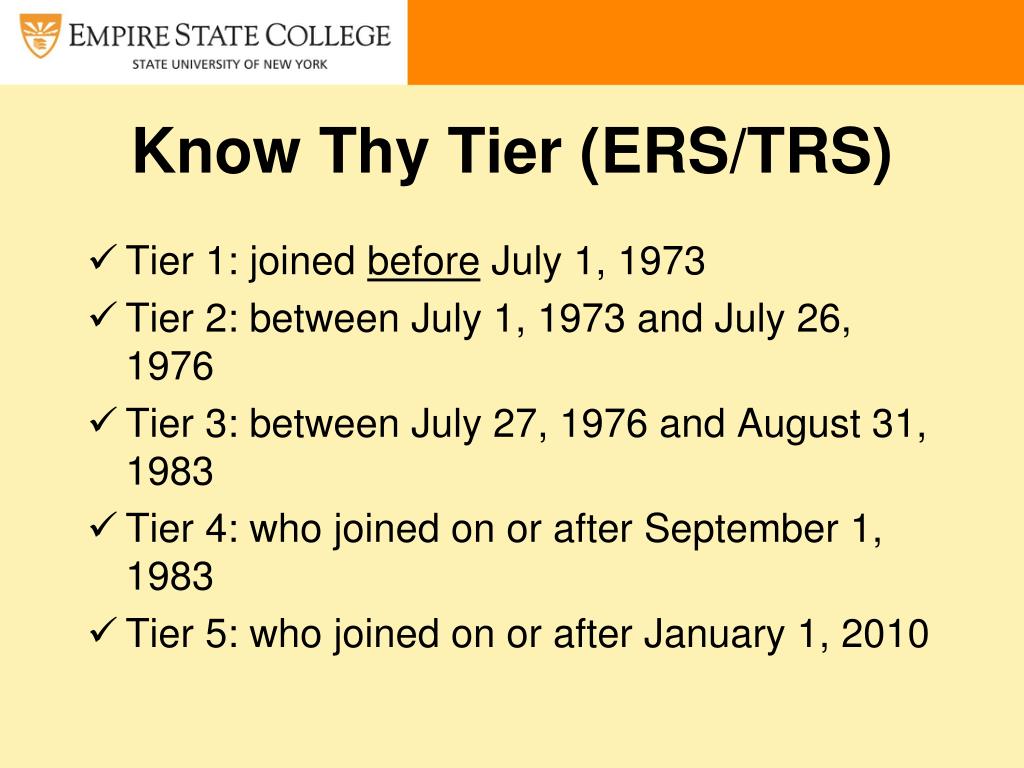

It's important to note that different tiers within the NYSTRS have varying requirements, so understanding your specific tier is vital for proper planning.

Types of Retirement Plans

NYSTRS offers several retirement plans, each designed to cater to different needs and preferences. Here are the main types:

1. Regular Retirement

Regular retirement is available to members who have met the age and service requirements. This is the most common option for retirees.

2. Early Retirement

Members may opt for early retirement if they meet specific age and service criteria, albeit with reduced benefits.

3. Disability Retirement

Disability retirement is an option for members who become unable to work due to a disability. This plan provides a safety net for those facing unforeseen challenges.

4. Survivor Benefits

In the event of a member's death, survivor benefits can be provided to dependents, ensuring financial support even after a member's passing.

Calculating Your Retirement Benefits

Calculating retirement benefits can be complex, but understanding the formula can help members estimate their future income. The formula typically includes:

- Years of service

- Final average salary (commonly the highest three consecutive years of earnings)

- Retirement benefit multiplier (varies by tier)

For example, a Tier 4 member with 30 years of service and a final average salary of $80,000 may calculate their pension as follows:

Benefit = Years of Service x Final Average Salary x Multiplier

Benefit = 30 x $80,000 x 0.02 = $48,000 annually.

Additional Benefits for Retirees

Aside from the standard retirement benefits, NYSTRS offers various additional benefits to enhance the financial security of its members. These include:

- Cost-of-living adjustments (COLA)

- Access to health insurance programs

- Financial planning resources

These benefits ensure that retirees can maintain their quality of life, even in the face of rising living costs.

Comparing NYSRS to Other Retirement Systems

When considering retirement options, it's essential to compare NYSTRS with other systems, such as the Federal Employees Retirement System (FERS) or private retirement plans. Here are some key differences:

- NYSTRS provides a defined benefit plan, while FERS offers a combination of defined benefits and contributions.

- NYSTRS benefits are generally more predictable, while private plans can be more variable.

- Members of NYSTRS often have additional protections, such as disability and survivor benefits.

Understanding these differences can help members make informed decisions regarding their retirement planning.

Conclusion

In summary, the New York State Retirement System is a vital resource for public employees, offering various retirement options and benefits. Understanding eligibility requirements, types of plans, and how to calculate benefits can significantly impact your financial future. We encourage you to explore your retirement options and consult with a retirement planner if needed.

If you found this article helpful, please consider leaving a comment or sharing it with others who may benefit from this information. Additionally, check out our other articles on retirement planning and financial security.

Thank you for reading, and we hope to see you back here for more insightful content!

Article Recommendations

ncG1vNJzZmilqZu8rbXAZ5qopV%2BcrrOwxKdvaK%2BnrHqwv8Jmqq2ZpJp6r8WMq5ytoaKae6nAzKU%3D