How did David Tepper get rich?

David Tepper is an American billionaire hedge fund manager and philanthropist. He is the founder and president of Appaloosa Management, a global investment firm. As of 2023, Tepper has an estimated net worth of $16.7 billion, making him one of the wealthiest people in the world.

Tepper's wealth primarily comes from his success in the financial markets. He began his career as a trader at Goldman Sachs in the early 1980s. In 1993, he founded Appaloosa Management, which has consistently generated high returns for its investors. Tepper's investment strategy is based on a combination of fundamental analysis and technical trading. He is known for his aggressive approach and his willingness to take on risk.

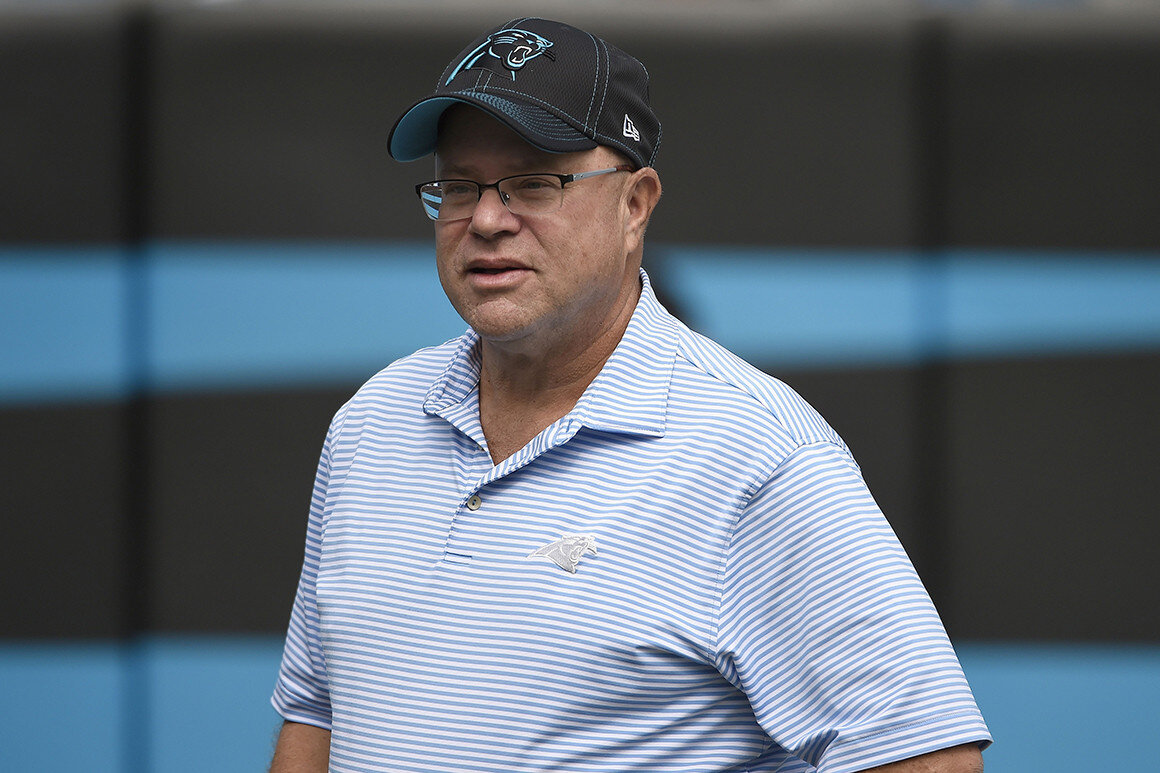

In addition to his hedge fund business, Tepper has also made significant investments in other areas, including real estate, sports teams, and technology companies. He is the owner of the Carolina Panthers of the National Football League and has a stake in the Pittsburgh Steelers. Tepper is also a major donor to charitable causes, particularly in the fields of education and healthcare.

Tepper's success is a testament to his skill as an investor and his willingness to take risks. He is a self-made billionaire who has achieved great wealth through his hard work and dedication.

How David Tepper Got Rich

Key Aspects:

- Hedge Fund Management: Tepper's primary source of wealth is his success as a hedge fund manager. He founded Appaloosa Management in 1993, which has consistently generated high returns for its investors.

- Investment Strategy: Tepper's investment strategy is based on a combination of fundamental analysis and technical trading. He is known for his aggressive approach and his willingness to take on risk.

- Other Investments: In addition to his hedge fund business, Tepper has also made significant investments in other areas, including real estate, sports teams, and technology companies.

- Philanthropy: Tepper is a major donor to charitable causes, particularly in the fields of education and healthcare.

Discussion:

Tepper's success as a hedge fund manager is due to a number of factors. First, he is a skilled investor with a deep understanding of the financial markets. Second, he is willing to take risks, which has allowed him to generate high returns for his investors. Finally, he has a strong team of professionals who support him in his investment decisions.

In addition to his hedge fund business, Tepper has also made significant investments in other areas. He is the owner of the Carolina Panthers of the National Football League and has a stake in the Pittsburgh Steelers. He is also a major investor in real estate and technology companies.

Tepper is a generous philanthropist who has donated millions of dollars to charitable causes. He is particularly interested in supporting education and healthcare. He has donated to a number of universities and hospitals, and he has also established his own foundation to support charitable causes.

Personal Details and Bio Data of David Tepper

| Name | David Alan Tepper |

|---|---|

| Date of Birth | September 11, 1957 |

| Place of Birth | Pittsburgh, Pennsylvania, U.S. |

| Alma Maters | University of Pittsburgh (B.S. in economics) Carnegie Mellon University (M.B.A.) |

| Occupation | Hedge fund manager Investor Philanthropist |

| Net Worth | $16.7 billion (as of 2023) |

How David Tepper Got Rich

David Tepper is an American billionaire hedge fund manager and philanthropist. He is the founder and president of Appaloosa Management, a global investment firm. As of 2023, Tepper has an estimated net worth of $16.7 billion, making him one of the wealthiest people in the world.

- Hedge Fund Management: Tepper's primary source of wealth is his success as a hedge fund manager.

- Investment Strategy: Tepper's investment strategy is based on a combination of fundamental analysis and technical trading.

- Risk Tolerance: Tepper is known for his aggressive approach and his willingness to take on risk.

- Team of Professionals: Tepper has a strong team of professionals who support him in his investment decisions.

- Real Estate Investments: In addition to his hedge fund business, Tepper has also made significant investments in real estate.

- Sports Team Ownership: Tepper is the owner of the Carolina Panthers of the National Football League.

- Technology Investments: Tepper is a major investor in technology companies.

- Philanthropy: Tepper is a generous philanthropist who has donated millions of dollars to charitable causes.

- Education Support: Tepper is particularly interested in supporting education.

- Healthcare Support: Tepper has also donated to a number of hospitals and healthcare organizations.

Tepper's success is a testament to his skill as an investor, his willingness to take risks, and his commitment to philanthropy.

Hedge Fund Management

David Tepper's success as a hedge fund manager is the primary reason for his immense wealth. Hedge fund management involves pooling money from investors and investing it in a wide range of assets, such as stocks, bonds, currencies, and commodities. Tepper's skill in identifying undervalued assets and making profitable trades has enabled him to generate substantial returns for his investors, resulting in the accumulation of his fortune.

One notable example of Tepper's successful hedge fund management is his investment in distressed assets during the 2008 financial crisis. He recognized the opportunity to acquire undervalued assets at a discount and invested heavily in companies that were facing financial difficulties. This strategy proved to be highly profitable as many of these companies recovered and their stock prices rebounded, leading to significant gains for Tepper and his investors.

Tepper's success in hedge fund management highlights the importance of expertise, risk management, and a deep understanding of the financial markets. His ability to identify and capitalize on market opportunities, combined with his aggressive approach and willingness to take calculated risks, has been instrumental in his wealth accumulation.

Investment Strategy

David Tepper's investment strategy is a key component of his success as a hedge fund manager and a major contributor to his wealth accumulation. His approach combines fundamental analysis and technical trading, offering a comprehensive understanding of the market and enabling him to make informed investment decisions.

Fundamental analysis involves evaluating a company's financial statements, industry trends, and economic factors to assess its intrinsic value. Tepper uses this approach to identify companies that are undervalued relative to their potential. He looks for companies with strong fundamentals, such as consistent earnings growth, low debt, and a competitive advantage. By investing in undervalued companies, Tepper aims to capitalize on their potential for growth and profit.

Technical trading, on the other hand, involves analyzing price charts and patterns to identify trading opportunities. Tepper uses technical analysis to determine the entry and exit points for his trades. He looks for patterns in price movements that suggest a stock is likely to continue trending in a particular direction. By combining fundamental analysis with technical trading, Tepper is able to make informed decisions about which stocks to buy and sell, and when to do so.

Tepper's investment strategy has proven to be successful over the long term. His ability to identify undervalued companies and make profitable trades has enabled him to generate substantial returns for his investors. His success highlights the importance of having a well-defined investment strategy and the ability to adapt to changing market conditions.

Risk Tolerance

David Tepper's risk tolerance has played a significant role in his wealth accumulation. His aggressive approach and willingness to take on risk have enabled him to make bold investment decisions that have resulted in substantial gains.

- Calculated Risks: Tepper carefully evaluates potential investments and takes calculated risks when he sees an opportunity for high returns. He is not afraid to invest in undervalued assets or to bet against market trends, as he did during the 2008 financial crisis.

- High-Conviction Investments: Tepper is known for making high-conviction investments, meaning he invests heavily in companies that he believes in. He is willing to hold these investments for the long term, even when they experience short-term fluctuations.

- Diversification: Despite his aggressive approach, Tepper also understands the importance of diversification. He invests in a wide range of assets, including stocks, bonds, commodities, and real estate, to mitigate risk.

- Risk Management: Tepper employs robust risk management strategies to minimize potential losses. He uses stop-loss orders and other risk-limiting techniques to protect his investments from excessive drawdowns.

Tepper's risk tolerance has been a double-edged sword. It has allowed him to generate substantial wealth, but it has also exposed him to potential losses. However, his ability to manage risk effectively has enabled him to navigate market volatility and protect his capital.

Team of Professionals

David Tepper's success as a hedge fund manager is not solely attributable to his individual skills and expertise. He has also benefited from the support of a strong team of professionals who assist him in making investment decisions.

Tepper's team consists of analysts, portfolio managers, and traders who have extensive experience in their respective fields. They conductfundamental and technical analysis of potential investments, providing Tepper with valuable insights and recommendations.

The team's collaborative approach allows them to share diverse perspectives and identify opportunities that might be missed by a single individual. They also work closely with Tepper to develop and implement investment strategies that align with the fund's objectives.

The importance of Tepper's team cannot be overstated. Their expertise and dedication have contributed significantly to his wealth accumulation. They have helped him to identify undervalued assets, make profitable trades, and manage risk effectively.

In conclusion, David Tepper's team of professionals is an integral part of his success story. Their collaboration, expertise, and commitment have enabled Tepper to make informed investment decisions and generate substantial returns for his investors.

Real Estate Investments

David Tepper's real estate investments have been a major contributor to his wealth accumulation. He has invested heavily in various real estate sectors, including residential, commercial, and land development.

- Income-Generating Properties: Tepper owns a portfolio of income-generating properties, such as apartment buildings, shopping centers, and office buildings. These properties provide a steady stream of rental income, which contributes to his overall wealth.

- Value-Add Investments: Tepper also engages in value-add investments, where he acquires undervalued properties, improves them, and sells them for a profit. This strategy has allowed him to generate substantial capital gains.

- Land Development: Tepper has invested in land development projects, particularly in the Charlotte, North Carolina area. He has developed residential and commercial properties, which have increased in value over time.

Tepper's success in real estate is attributed to his ability to identify undervalued assets and his willingness to invest long-term. He has a deep understanding of the real estate market and has assembled a team of experienced professionals to manage his investments.

Overall, Tepper's real estate investments have played a significant role in his wealth accumulation and have contributed to his status as one of the wealthiest people in the world.

Sports Team Ownership

David Tepper's ownership of the Carolina Panthers has been both a passion project and a financially rewarding investment. The purchase of the team in 2018 added a significant asset to his portfolio and contributed to his overall wealth.

Sports team ownership provides several financial benefits. Firstly, teams can generate revenue through ticket sales, concessions, and merchandise. The Panthers, for example, have a large and loyal fan base that supports the team both financially and emotionally.

Secondly, sports teams can appreciate in value over time. When Tepper purchased the Panthers, the team was valued at around $2.2 billion. Today, the team is worth an estimated $3 billion, representing a significant increase in value.

However, it is important to note that sports team ownership also comes with risks. Teams can experience financial losses, especially during periods of poor performance or economic downturns. Additionally, the value of a team can fluctuate based on factors such as player performance and league popularity.

Overall, David Tepper's ownership of the Carolina Panthers has been a positive addition to his financial portfolio. The team has generated revenue, appreciated in value, and provided Tepper with a platform to engage with the community. While there are risks associated with sports team ownership, Tepper's experience and financial resources have allowed him to mitigate these risks and reap the benefits of owning a professional sports franchise.

Technology Investments

David Tepper's investments in technology companies have significantly contributed to his wealth accumulation. He has a deep understanding of the technology sector and has invested in a wide range of companies, from established tech giants to promising startups.

One notable example of Tepper's successful technology investments is his early investment in Amazon. He recognized the potential of e-commerce and invested in Amazon in the late 1990s. Amazon's subsequent growth and dominance in the e-commerce market have resulted in substantial gains for Tepper.

Tepper also invests in technology companies that are developing innovative technologies, such as artificial intelligence and machine learning. He believes that these technologies have the potential to transform industries and create significant value for investors.

Tepper's technology investments highlight the importance of staying ahead of the curve and investing in emerging technologies. His ability to identify and invest in successful technology companies has been a major driver of his wealth accumulation.

Philanthropy

David Tepper's philanthropy is not only a reflection of his wealth but also an integral part of how he got rich. His success in business has enabled him to give back to society and make a positive impact on the world.

Tepper's charitable donations have primarily focused on education and healthcare. He has donated millions of dollars to universities, hospitals, and other non-profit organizations that support these causes. His philanthropy has helped to improve access to education for underprivileged students, fund medical research, and provide healthcare services to those in need.

Philanthropy can be seen as a form of long-term investment that benefits not only the recipients of the donations but also the donor. By supporting education and healthcare, Tepper is investing in the future of society and creating a more just and equitable world. This, in turn, can have a positive impact on the economy and contribute to overall prosperity.

Tepper's philanthropy is a testament to his belief that wealth should be used to make a difference in the world. His charitable donations have not only helped those in need but have also contributed to the greater good of society.

Education Support

David Tepper's support for education is closely connected to his wealth accumulation and overall success. Investing in education is not only a philanthropic act but also a strategic move that contributes to a more prosperous and stable society.

An educated workforce is essential for economic growth and innovation. By supporting education, Tepper is investing in the future of the economy and creating a more favorable environment for businesses to thrive. An educated population is more likely to be employed, earn higher wages, and contribute to the overall well-being of society.

Furthermore, education empowers individuals and provides them with the skills and knowledge they need to succeed in life. By supporting educational opportunities, Tepper is creating a more equitable society and giving everyone a fair chance to achieve their full potential.

In conclusion, David Tepper's support for education is not only a reflection of his wealth but also a wise investment that benefits both society and his business interests. By investing in the future of education, he is contributing to a more prosperous and just world.

Healthcare Support

David Tepper's healthcare support is an important component of his wealth accumulation story. By investing in healthcare, he is not only making a positive impact on society, but also contributing to the overall prosperity that has led to his financial success.

A healthy population is a productive population. By supporting healthcare organizations, Tepper is helping to ensure that the workforce is healthy and able to contribute to the economy. This, in turn, benefits businesses like Tepper's, which rely on a skilled and healthy workforce to operate and grow.

Furthermore, a strong healthcare system attracts and retains talented individuals. By investing in healthcare, Tepper is making the region more attractive to businesses and professionals, which can lead to increased economic growth and prosperity.

In conclusion, David Tepper's healthcare support is not only a philanthropic act but also a strategic investment that has contributed to his wealth accumulation. By investing in the health of the population, he is creating a more favorable environment for businesses to thrive and contributing to the overall prosperity of society.

FAQs on How David Tepper Got Rich

Here are some frequently asked questions about David Tepper's wealth and success:

Question 1: What is the primary source of David Tepper's wealth?

David Tepper's primary source of wealth is his success as a hedge fund manager. He founded Appaloosa Management in 1993, which has consistently generated high returns for its investors. Tepper's investment strategy is based on a combination of fundamental analysis and technical trading, and he is known for his aggressive approach and willingness to take on risk.

Question 2: How has Tepper's philanthropy contributed to his wealth?

Tepper's philanthropy is not only a reflection of his wealth but also a strategic move that has contributed to his overall success. By investing in education and healthcare, he is creating a more prosperous and stable society, which benefits businesses like his that rely on a skilled workforce and a healthy population. Furthermore, his philanthropic efforts have enhanced his reputation and made him a respected figure in the business community, which can lead to new opportunities and partnerships.

In conclusion, David Tepper's wealth accumulation is the result of a combination of factors, including his skill as a hedge fund manager, his willingness to take risks, and his commitment to philanthropy. His success story serves as an inspiration to aspiring investors and entrepreneurs worldwide.

Conclusion

David Tepper's journey to becoming one of the wealthiest people in the world is a testament to his skill as an investor, his willingness to take risks, and his commitment to philanthropy. His success as a hedge fund manager, combined with his strategic investments in real estate, sports teams, and technology companies, has significantly contributed to his immense wealth.

Tepper's philanthropic efforts, particularly in the areas of education and healthcare, have not only made a positive impact on society but have also contributed to his overall success. By investing in the future of the population, he has created a more favorable environment for businesses to thrive and has enhanced his reputation as a respected figure in the business community.

Tepper's story serves as an inspiration to aspiring investors and entrepreneurs worldwide, demonstrating that success can be achieved through hard work, dedication, and a commitment to making a difference in the world.

Article Recommendations

ncG1vNJzZmilqZu8rbXAZ5qopV%2Bau7Wx0a2Yoqadmru1hI6hprBllJ6xbrDAr6CdZaSavbGx0Waenqxdp7aktI2hq6ak