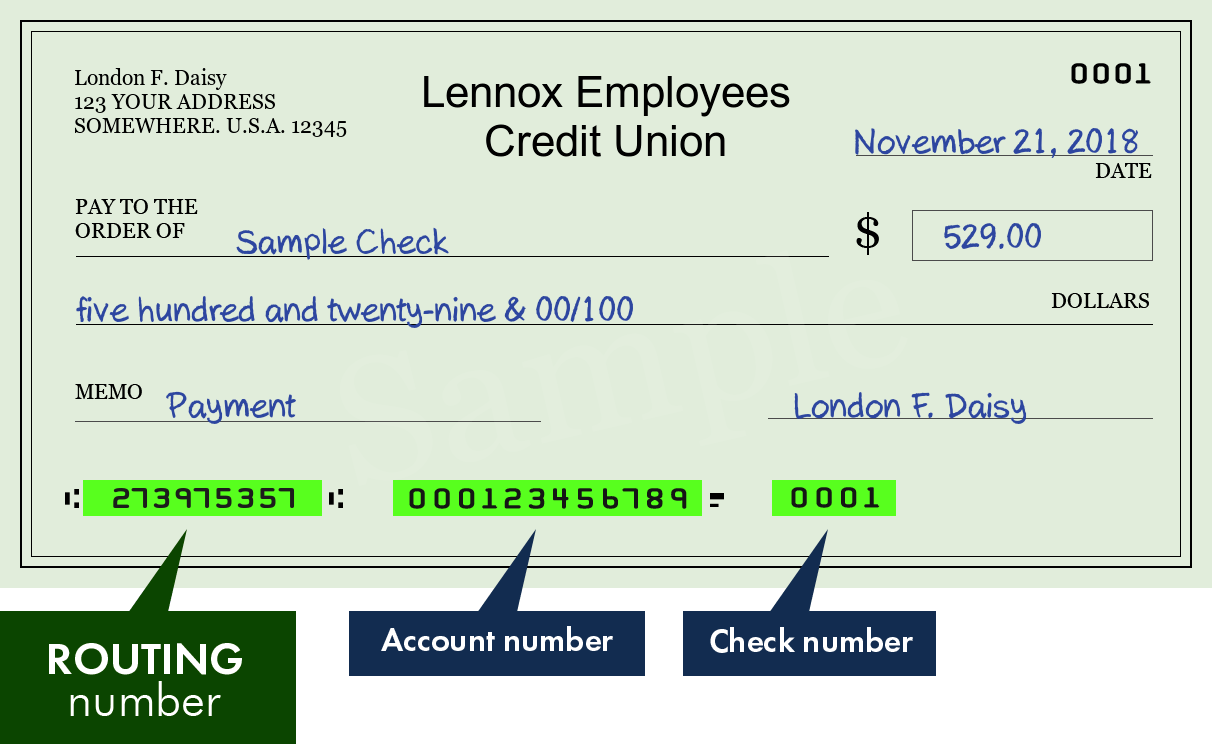

Lennox Employees Credit Union is a unique financial institution designed specifically for the employees of Lennox International Inc. and their families. Established with the mission to provide accessible financial services, this credit union has become a vital resource for its members, offering a range of products that cater to their financial needs. In this article, we will explore the various features of Lennox Employees Credit Union, its history, services, and how it stands out in the realm of financial institutions.

Founded in the heart of the Lennox International community, Lennox Employees Credit Union has built a reputation for reliability and trustworthiness among its members. With a focus on serving the financial interests of its members, the credit union has developed a range of products that include savings accounts, loans, and financial education resources. Understanding the importance of financial literacy, the credit union actively promotes educational initiatives that empower its members to make informed financial decisions.

In the following sections, we will delve deeper into the operational aspects of Lennox Employees Credit Union, the benefits of membership, and how it has evolved to meet the changing needs of its members. Whether you're an employee of Lennox International or a family member, this article will provide you with valuable insights into the credit union's offerings and how they can enhance your financial well-being.

Table of Contents

History of Lennox Employees Credit Union

Lennox Employees Credit Union was established in [insert year here], aimed at providing financial services to the employees of Lennox International Inc. The credit union was founded on the principles of cooperation and mutual assistance, allowing members to pool their resources for greater financial strength. Over the years, it has grown in membership and service offerings, adapting to the evolving needs of its members.

Initially, the credit union started with basic services such as savings accounts and personal loans. However, as the needs of the workforce expanded, so did the range of services available. Today, Lennox Employees Credit Union stands as a testament to the commitment of Lennox International to the financial well-being of its employees.

Membership Benefits

Joining Lennox Employees Credit Union comes with a variety of benefits that are tailored to enhance the financial experience of its members. Some of the key benefits include:

- Access to competitive interest rates on loans and savings.

- Low or no fees for various services.

- Personalized customer service from knowledgeable staff.

- Financial education resources to improve financial literacy.

- Online banking services for convenience.

Eligibility Criteria

Membership is primarily open to employees of Lennox International Inc. and their immediate family members. This inclusive policy ensures that not only employees but also their families can benefit from the credit union’s services.

Services Offered

Lennox Employees Credit Union provides a comprehensive range of financial services designed to meet the diverse needs of its members. The main services include:

- Savings Accounts

- Checking Accounts

- Personal Loans

- Auto Loans

- Home Equity Loans

- Credit Cards

Digital Banking Services

In today’s digital age, Lennox Employees Credit Union recognizes the importance of providing digital banking services. Members can access their accounts online, transfer funds, and pay bills conveniently from anywhere.

Financial Education Initiatives

Lennox Employees Credit Union places a strong emphasis on financial education. The credit union regularly hosts workshops and seminars aimed at improving the financial literacy of its members. These initiatives cover various topics, including budgeting, saving for retirement, and managing debt.

By empowering members with knowledge, the credit union aims to promote better financial decision-making and long-term financial stability.

Loan Options Available

Lennox Employees Credit Union offers a variety of loan options to cater to the diverse needs of its members. These options include:

- Personal Loans: Flexible loans for various personal needs.

- Auto Loans: Competitive rates for purchasing vehicles.

- Home Equity Loans: Utilize the equity in your home for major expenses or projects.

Application Process

The application process for loans at Lennox Employees Credit Union is straightforward and designed for convenience. Members can apply online or visit a branch for assistance.

Saving Plans and Accounts

Saving is an essential part of financial health, and Lennox Employees Credit Union offers various saving plans to help members achieve their financial goals. The available saving options include:

- Regular Savings Accounts: Standard accounts with competitive interest rates.

- High-Yield Savings Accounts: Accounts designed to maximize savings.

- Certificates of Deposit (CDs): Fixed-term investments with higher interest rates.

Benefits of Saving with Lennox Employees Credit Union

Members benefit from higher interest rates compared to traditional banks, ensuring their savings grow effectively over time.

Community Involvement

Lennox Employees Credit Union is not just focused on financial services; it also plays an active role in the community. The credit union frequently engages in community service projects and supports local charities. This commitment to community involvement fosters a sense of solidarity among members and enhances the credit union’s reputation.

Conclusion

In summary, Lennox Employees Credit Union stands as a pillar of support for the employees of Lennox International Inc. and their families. With a rich history, a wide array of services, and a commitment to financial education, the credit union empowers its members to achieve their financial goals. If you are an employee or a family member, consider becoming a member of Lennox Employees Credit Union to take advantage of the numerous benefits it offers.

We invite you to share your thoughts in the comments below, or feel free to explore more articles on our site to enhance your financial knowledge.

Thank you for reading! We hope to see you back here soon for more insightful articles.

Article Recommendations

ncG1vNJzZmilqZu8rbXAZ5qopV%2BcrrOwxKdraKSVo7uwxIyepKmkn66ypr%2BMnKmenJmpera6yKilZ6Ckork%3D