Are you tired of living paycheck to paycheck and feeling overwhelmed by your financial situation? If so, you are not alone. Many individuals struggle with budgeting and managing their expenses effectively. However, there's a solution that can empower you to take control of your finances: gomyfinance.com "create" budget. This online platform offers an innovative approach to budgeting that simplifies the process and makes it accessible for everyone.

In today’s fast-paced world, financial literacy is more important than ever. Understanding how to create a budget is a fundamental skill that can significantly improve your financial health. gomyfinance.com "create" budget provides the tools and resources necessary to help you build a budget tailored to your unique needs and goals. With user-friendly interfaces and practical tips, this platform is designed to support anyone looking to gain financial stability.

Whether you are saving for a major purchase, paying off debt, or simply trying to keep track of your expenses, gomyfinance.com "create" budget can guide you every step of the way. By following its structured approach, you can learn how to allocate your income wisely, set achievable financial goals, and ultimately achieve a more secure and stress-free financial future.

What is gomyfinance.com "create" budget?

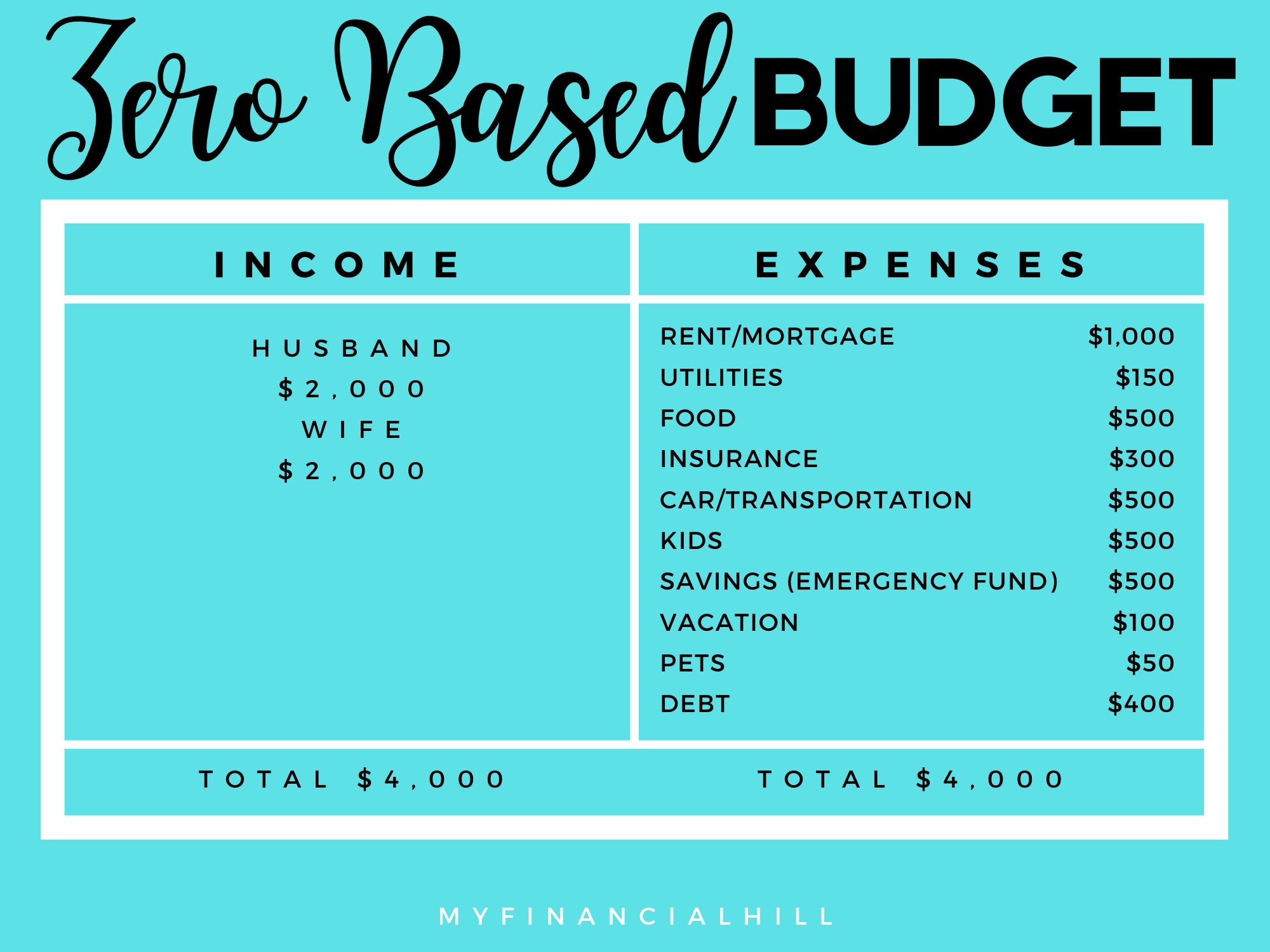

gomyfinance.com "create" budget is an online financial tool that helps users develop and manage their personal budgets effectively. With its intuitive design, users can easily input their income and expenses to visualize their financial situation. The platform provides various budgeting templates and calculators that make it simple for anyone to get started.

Why is Budgeting Important?

Budgeting is essential for achieving financial stability and success. Here are a few reasons why you should prioritize creating a budget:

- Helps track spending and identify areas for improvement.

- Enables you to set and achieve financial goals.

- Reduces financial stress by providing clarity on your financial situation.

- Assists in avoiding debt and living within your means.

How Can gomyfinance.com "create" budget Help You?

The platform offers several features that make budgeting easier and more effective:

What Steps Should You Follow to Create a Budget on gomyfinance.com?

Creating a budget on gomyfinance.com is a straightforward process. Here’s how to get started:

Can You Use gomyfinance.com "create" budget for Debt Management?

Absolutely! One of the powerful features of gomyfinance.com "create" budget is its capability to assist with debt management. By inputting your debts into the budgeting tool, you can see how much of your income is allocated to debt repayment and make necessary adjustments. This enables you to create a strategy to pay down your debts more effectively.

What Are the Common Budgeting Mistakes to Avoid?

As you embark on your budgeting journey, be mindful of these common pitfalls:

- Not tracking all expenses, leading to an inaccurate budget.

- Setting unrealistic goals that are hard to achieve.

- Failing to adjust the budget as circumstances change.

- Not accounting for irregular expenses, such as car maintenance or medical bills.

How Can You Stay Motivated While Budgeting?

Staying motivated is crucial for sticking to your budget. Here are some tips to help you remain committed:

- Celebrate small victories to keep morale high.

- Regularly review your goals and remind yourself why you started budgeting.

- Engage with a community or support group for shared motivation.

Conclusion: Take Control of Your Finances with gomyfinance.com "create" budget

In conclusion, gomyfinance.com "create" budget is an invaluable resource for anyone seeking to improve their financial literacy and management skills. By utilizing this platform, you can develop a personalized budget that aligns with your financial goals, helping you achieve stability and peace of mind. Don't let financial stress hold you back; embrace the power of budgeting today!

Article Recommendations

ncG1vNJzZmilqZu8rbXAZ5qopV%2BWtLOxwKylnq%2BjZn9ws86msJ%2Bhnpa7pLHCqKRmm6KarrWxjJusnZ%2BVqXupwMyl